ITR-7 Form - Eligibility, Income Tax Guidelines

This page describes guidelines for filing the ITR-7 Form with explaining its sections and various parts. This income tax return form is designed certain types of taxpayers and businesses and it can be filed online and offline mode.

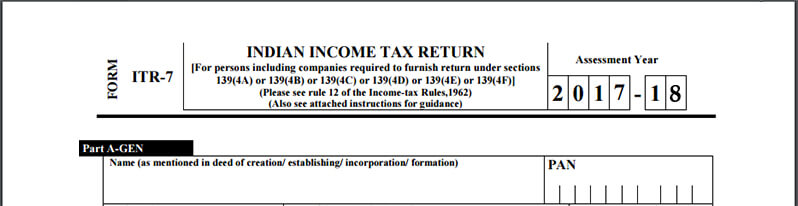

Defining ITR-7 Form

Any individual or business who falls under Section 139(4A) / 139(4C) / 139(4D). It does not require any attachments to be sent or submitted while filing this form. All the taxpayer need to do is match the details of this income tax return form with the Tax Credit Statement Form 26AS.

Audit Liabilities

If the taxpayer falls under the category described under Section 44AB and liable for audit must need to furnish this inform section under the "Audit Information" head. These taxpayers need to audit their accounts by an accountant. If taxpayer’s audit liability falls under the section 10(23C)(iv) / 10(23C)(v) / 10(23C)(vi) / 10(23C)(vi a) / 10A / 12A(1)(b) / 44AB / 80-IA / 80-IB / 80-IC / 80-ID / 80JJA / 80LA / 92E / 115JB must need to submit the audit details electronically before filing ITR with this income tax return form.

Eligibility to file income tax return with ITR-7 Form

- Any person receives income from a property owned by a charitable or religious trust need to file ITR with this form under section 139(4A).

- If any political party exceeds the minimum tax-free amount and does not affect the conditions of section 139(4A) then they need to use this income tax return form to file annual ITR as prescribed under section 139(4B).

- Under section 139(4C), following category of taxpayers need to use this for to file ITR:

- News agency

- Scientific research association

- Institutions mentioned under section 10(23b)

- Association / institution referred under section 10(23a)

- Funds / institutions / universities / educational institutions / hospitals / medical institutions

- Any educational institution that does nit fall under any of the above provision require using this form to file ITR under section 139(4D).

The Sections of ITR-7 Form

The income tax return form is divided into 2 parts and 23 schedules:

- Part A-General information and details

- Part B-total income details and tax calculation for the taxable income

- Schedule-I: details of amounts that has not been used as prescribed in section 11(2) in previous year’s viz., previous years relevant to the current assessment year.

- Schedule-J: details of all invested funds by the Trust / Institution as on the last day of the previous financial year.

- Schedule-K: particulars details of the Author(s) / Founder(s) / Trustee(s) / Manager(s), etc., of the Trust / Institution.

- Schedule-LA: information in case of a political party

- Schedule-ET: information in case of an Electoral Trust

- Schedule-HP: details of income arose from house property

- Schedule-CG: income calculation for Capital gains

- Schedule-OS: income calculation for other sources

- Schedule-VC: information of voluntary contributions received

- Schedule-OA: information of any business and profession

- Schedule-BP: income calculation of profit and gains from any business or profession

- Schedule-CYLA: income details after setting off the losses from current year

- Schedule-MAT: calculation of Minimum Alternate Tax payable under section 115JB (n)

- Schedule-MATC: calculation of tax credit under section 115JAA

- Schedule-AMT: calculation of Alternate Minimum Tax payable under section 115JC (p)

- Schedule-AMTC: calculation of tax credit under section 115JD

- Schedule-SI: details of income that are taxable at a special rate

- Schedule-IT: details of advance-tax payment and tax on self-assessment

- Schedule-TDS: details of TDS applicable on income other than for salary

- Schedule-TCS: details of TCS

- Schedule-FSI: details of foreign income

- Schedule-TR: details of tax deductions claimed under section 90 / 90A / 91

- Schedule-FA: details of Foreign Assets

Filling the ITR-7 Form

Filling instructions for ITR-7:

- Write “---NA---“ for the schedules not applicable to you

- Write “NA” for the item not applicable to you

- Write “Nil” for the figures that have a NIL value

- Write “-” for the negative figures

- All figures must be round off to next 1 rupee and all total income / loss / tax payable must be rounded offf to the next multiple of 10 rupees.

Filling Sequence for parts and schedules

- Part A

- Schedules

- Part B

- Verification

Filing ITR-3 Form

Online / Electronically:

- File return electronically under digital signature

- Transmit data electronically

- Submit the verification Form ITR-V to CPC Bangalore

Offline:

- Furnish income tax return in a physical paper form

- Furnish a bar-coded income tax return

- A paper acknowledgment will be issued at the time of submission.

Frequently Asked Questions

In such case, an application to the Commissioner of Income Tax need to be made in Form 10A with attaching the following documents:

- Form 10A

- NGO establishment documentations

- Last 3 year’s accounts should be enclosed. If the NGO is less than 3 years old then they can submit income statements for lesser years.

Under Section 2(15) of the Income Tax Act, the term "charitable purpose" includes:

- Education

- Relief of the poor

- Medical Relief

- The advancement of any general public utility

- Environmental preservation including watershed, forests, and wildlife

- Monuments / historic place / artistic / historic interest preservation

Under section 13, political parties are eligible to get 100% tax exemption on all income sources. Yet they are required to file ITR on every AY with providing the following statements:

- Audited Accounts

- Balance Sheet

- Income Details

- Expense Details

Types of ITR Forms

Types of ITR Forms