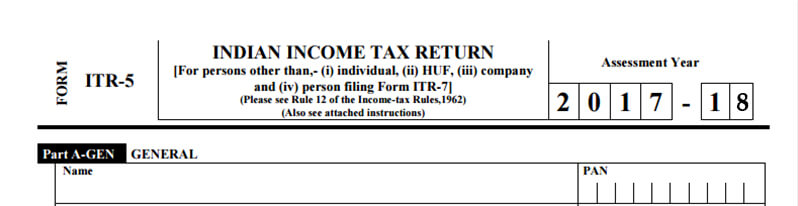

ITR-5 Form - Eligibility, Guidelines and Form Sections

It’s a category specific income tax return form and applicable to the certain category of taxpayers only. This page describes the use of ITR-V form including filing instructions and related terminologies. This is a comprehensive guideline for filing and uses this form.

Defining ITR-5 Form

This form is used by the firms, LLPs, Association of persons (AOPs), Body of Individuals (BOIs), Cooperative Societies, Artificial Judicial Persons, and Local Authorities. But the taxpayer who falls under the category described in Sections 139(4A), 139(4B), 139(4C), or 139(4D) do not need to use this form to file income tax return.

Those who need to file audit reports under sections 10(23C)(iv), 10(23C)(v), 10(23C)(vi), 10(23C)(via), 10A, 10AA, 12A(1)(b), 44AB, 44DA, 50B, 80-IA, 80-IB, 80-IC, 80-ID, 80JJAA, 80LA, 92E, 115JB or 115VW, must file it online before the filing date of ITR form.

Eligibility to file income tax return with ITR-5 Form

Any person who owns a firm or LLPs or are a person of OP, BOI, co-operative society, local authority and the artificial juridical person described in section 2(31)(vii) can use this form to file income tax return.

The Sections of ITR-5 Form

ITR-5 form is divided into two parts and 30 schedules

The parts are:

- Part A: information of the taxpayer and earnings

- Part B: details of total income, taxable income and tax calculation

The 30 schedules are:

- Schedule-HP: calculation of income generated from House Property

- Schedule-BP: details of income generated from profit and gains

- Schedule-DPM: calculation of depreciation of plant and

- Schedule-DOA: calculation of depreciation applicable to other assets

- Schedule-DEP: brief of depreciation applicable to all the assets

- Schedule-DCG: calculation of deemed capital gains generated on depreciable assets sale

- Schedule-ESR: deductions applicable under section 35 for expenditure on scientific research

- Schedule-CG: calculation of income from Capital gains.

- Schedule-OS: calculation of income from other sources.

- Schedule-CYLA: details of income after setting off all losses occurred in present year

- Schedule-BFLA: details of income after setting off the unabsorbed loss brought forwarded from earlier years

- Schedule-CFL: details of losses that will be carry forwarded to future years.

- Schedule-UD: details of unabsorbed Depreciation

- Schedule-10A: detailed calculation of deductions claimed under section 10A

- Schedule-10AA: calculation of deductions under section 10AA

- Schedule-80G: details of donations made that are eligible for deduction under section 80G

- Schedule-80IA: calculation of deductions applicable under section 80IA

- Schedule-80IB: calculation of deductions applicable under section 80IB

- Schedule-80IC/ 80-IE: calculation of deductions applicable under section 80IC / 80-IE.

- Schedule-VIA: details of deductions claimed against from total income

- Schedule-AMT: calculation of Alternate Minimum Tax payable u/s 115JC

- Schedule-AMTC: calculation of tax credit under section 115JD

- Schedule-SI: details of income taxable at special rates

- schedule-EI: details of exempted income other than total income

- Schedule-IT: details of advance-tax and self-assessment payment

- Schedule-TDS: details of TDS deducted on other income.

- Schedule-TCS: details of TCS applicable

- Schedule-FSI: details of income generated in abroad

- Schedule-TR: details of tax paid in abroad

- Schedule-FA: details of assets situated in foreign

Filling the ITR-5 Form

Filling Sequence for parts and schedules

The best sequence for filing ITR as recommended by the Income Tax Department is:

- Part A

- All the schedules

- Part B

- Verification

Filling instructions for ITR-5:

- Any schedules that are not applicable to you, write “---NA---" against them

- Any items that are not applicable to you, write “NA" for them

- For the nil value figures, write “NIL” behind them.

- Use “-" sign for the negative figures

- All figures must be rounded off to the nearest one rupee figure except for the total income / loss and tax payable, which need to be rounded off to the nearest multiple of ten rupees.

ITR-5 can be filed through online and offline mode according to your choice.

Offline:

- File income tax return with a physical paper form

- File a bar-coded income tax return

In the case of physical filing, an acknowledgment will be issued to you in paper form at the time of submitting ITR-4.

Two copies of the ITR-V should be printed and one need to be signed accordingly and sent to the CPC office in Bangalore. You must keep the other one for records.

Online / Electronically:

- By filing online return using digital signature

- By electronically transmitting the data

- By electronically transmitting the data

- Sending the Form ITR-V to CPC Bangalore

No Annexures Required

ITR-5 requires no document to be attached with it while submitting it online or offline mode. The income tax department advises the taxpayers to cross-check all the details with their Tax Credit Statement Form 26A.

Types of ITR Forms

Types of ITR Forms