ITR-6 Form - Income Tax Filing Guidelines, Eligibility

This page explains all essential need-to-know about ITR-6 Form including eligibility, form structure, filing guidelines and related terms and definition. This form is used by the companies who does not claim the exemption mentioned under Section-11. The exemptions mentioned under Section 11 are the ones who earn income from the religious or charitable trust.

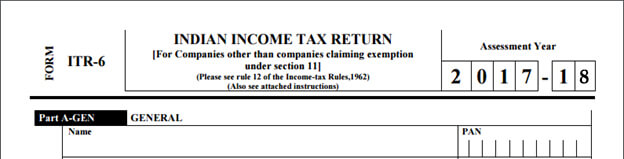

Defining ITR-6 Form

ITR-6 is designed for the companies and business organizations who does not hold any income share from the religious or charitable trust. Any organization which does not claim any exemption under Section11 can use this form to the E-file income tax return.

E-filing audit reports

The taxpayers liable to file ITR with Form ITR-6 may require to e-file audit reports under section 44AB and in that case, they need to obtain an audit report from an accountant. The details of that audit report along with furnishing date must be mentioned under the head "Audit Information" in the Form ITR-6. If the taxpayers submit an audit report under Section 10(23C)(iv), 10(23C)(v), 10(23C)(vi), 10(23C)(vi a), 10A, 12A(1)(b), 44AB, 80-IA, 80-IB, 80-IC, 80-ID, 80JJA, 80LA, 92E or 115JB, then they need to e-file the audit report before the ITR filing date.

The Sections of ITR-6 Form

The form is divided into parts and schedules and they have various sections including personal and income-related information.

The parts are:

- Part A: all personal information

- Part B: details of total income and tax calculation for the taxable amount.

The 33 schedules are:

- Schedule-BA: Bank account Details

- Schedule-HP: Income from House Property calculation

- Schedule-BP: "profit and gains from business or profession" calculation

- Schedule-DPM: calculation of depreciation on plant and machinery

- Schedule-DOA: calculation of depreciation on other assets

- Schedule-DEP: details of depreciation on all assets

- Schedule-DCG: calculation of deemed capital gains against sale of depreciable assets

- Schedule-ESR: Deductions claimed under section 35

- Schedule-CG: calculation of income under the Capital gains head.

- Schedule-OS: calculation of income from other sources.

- Schedule-CYLA: details of income after settling off current year's losses

- Schedule-BFLA: details of income after settling off unabsorbed loss brought forward from previous years.

- Schedule-CFL: details of losses to be carried forward to next year.

- Schedule-UD: Particulars of unabsorbed depreciation

- Schedule-10A: calculation of deductions claimed under section 10A

- Schedule-10AA: calculation of deduction claimed under section 10AA

- Schedule-80G: Details of donation entitled for deduction claimed under section 80G

- Schedule-80IA: calculation of deduction claimed under section 80IA

- Schedule-80IB: calculation of deduction claimed under section 80IB

- Schedule-80IC or 80IE: calculation of deduction claimed under section 80IC or 80 IE

- Schedule-VIA: details of deductions from total income under Chapter VIA.

- Schedule-SI: details of income which is chargeable to tax at special rates

- Schedule-EI: details of Income that is not mentioned in total income (exempt incomes)

- Schedule-MAT: calculation of Minimum Alternate Tax payable mentioned under section 115JB

- Schedule-MATC: calculation of tax credit mentioned under section 115JAA

- Schedule-DDT: details of Dividend Distribution Tax payment

- Schedule BBS: details of tax levied on distributed income of domestic company on buy back of shares, not listed on stock exchange

- Schedule-IT: details of advance-tax and tax on self-assessment payment

- Schedule-TDS: details of tax deducted at source on income other than salary.

- Schedule-TCS: details of tax collected at source

- Schedule-FSI: details of foreign income

- Schedule-TR: details of taxes paid in abroad

- Schedule-FA: all details of Foreign Assets

Filling the ITR-6 Form

Filling instructions for ITR-6

- If any of the section is not applicable to you then score across as “---NA---".

- If any of the items is not applicable to you, write “NA" against that.

- Write “Nil" where the answer for the figure is nil.

- For a negative figure / figure of loss, write “-" before that except as provided in the form.

- All figures should be mentioned in round figure to the next rupee figure. However, for total income / loss and tax payable figures, they need to be finally rounded off to the nearest multiple of 10 rupees.

Filling Sequence for parts and schedules

The sequence to fill out the ITR-6 should be in the following order:

- Part A

- Schedules

- Part B

- Verification

Filing ITR-6 Form

This form compulsorily needs to be filed electronically under digital signature or DSA to the Income Tax Department.

No Annexures Required

No documents even the TDS certificate is required to be attached with this ITR form. If any attachments are furnished, then they will be returned to the taxpayer. Also, taxpayers are required to match details mentioned in this form with the details mentioned in their Tax Credit Statement Form 26AS.

Filing the Verification Document

Fill up all the required information in the verification document and strike out whichever is not applicable to you. Also, sign the verification before furnishing the return along with mentioning your designation. For furnishing any false statement, you can be prosecuted under section 277 of the Income-tax Act, 1961 which can result in rigorous imprisonment and fine if proved.

Types of ITR Forms

Types of ITR Forms