Migration to GST

Transition for new businesses and businesses already registered under any current indirect taxation system.

We at All India ITR, provide expert assistance for GST or Goods and Services Tax enrollment. The recent announcement of submerging all existing indirect taxes such as excise duty, custom duty, entry tax, service tax or value added tax into one ground has given birth to GST. This will be the comprehensive tax system made to apply on manufacturing, selling and consumption of goods and services. It will be applied at each stage of purchasing and selling goods across India and all states will be covered under the same umbrella strategy. Although, the threshold for GST is different in northeastern states and other states including Union Territories. For all over India, the threshold has been set to an annual turnover of INR 20 lakhs excluding the seven northeastern states. For the northeastern states, it is set to an annual turnover of INR 10 lakhs. Our services are customised according to each state and their scheduled deadlines, so that anyone across India can avail the best trusted services to get registered under GST umbrella.

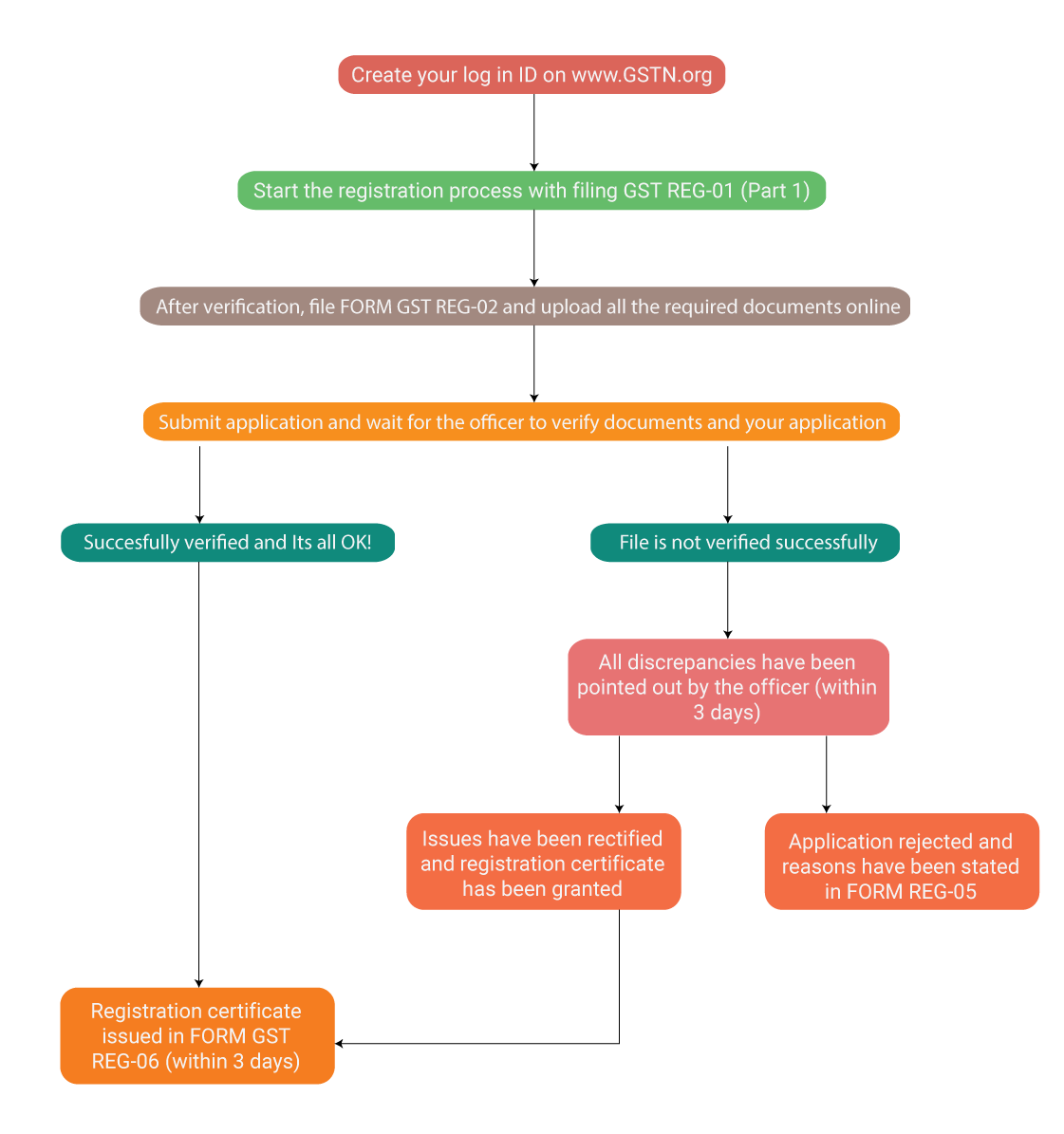

The Pathway To Get Registered Under GST

The GST registration process is simple and we will provide assistance in each step of the process so that you get your GSTIN in a smooth way.

Documents Required:

For Sole Proprietors:

- Provisional ID received from State/Central Authorities

- Password received from the State/Central Authorities

- Valid Email Address

- Valid Mobile Number

- Bank Account Details

- Copy of Registration Certificate in any law (RC)

- Details of Proprietor (with name, DOB, Mobile No., Designation, PAN, Aadhaar No., Address Proof, Photograph of such person in JPEG format in maximum size of 100 KB)

- Proof of Principal Place of Business such as rent agreement or municipal tax paid receipt or electricity bill in JPEG format in maximum size of 100 KB (with address, Email ID, Mob. No., Nature of business activity)

- Proof of Appointment of Authorized Signatory such as letter of authorization in PDF or JPEG format in maximum size of 1 MB (With Name, DOB, Mobile No, Designation, PAN, Aadhaar No., Address Proof, Photograph of Authorized Signatory in JPEG format in maximum size of 100 KB)

- Proof of Additional Place of Business, if any, in JPEG format in maximum size of 100 KB (with address, Email ID, Mob. No., Nature of business activity)

- All Bank Account Details (With Opening page of Bank Passbook / Statement containing Bank Account Number of , Address of Branch, Address of Account holder and few transaction details (PDF and JPEG format in maximum size of 1 MB)

- DSC Details, if available (with common name, Issuer name, Serial No., Expiry Date)

For Partnership Firm/HUF:

- Provisional ID received from State/Central Authorities

- Password received from the State/Central Authorities

- Valid Email Address

- Valid Mobile Number

- Bank Account Details

- Copy of Registration Certificate in any law (RC)

- Proof of Constitution of Business: Partnership Deed of Partnership Firm and HUF Deed in case of HUF (PDF and JPEG format in maximum size of 1 MB)

- Details of Partners/Karta of HUF (With Name, DOB, Mobile No, Designation, PAN, Aadhaar No., Address Proof, Photograph of such person in JPEG format in maximum size of 100 KB)

- Proof of Appointment of Authorized Signatory such as letter of authorization in PDF or JPEG format in maximum size of 1 MB (With Name,DOB, Mobile No, Designation, PAN, Aadhaar No., Address Proof, Photograph of Authorized Signatory in JPEG format in maximum size of 100 KB)

- Proof of Principal Place of Business such as rent agreement or electricity bill or property tax receipt etc. in JPEG format in maximum size of 100 KB (with address, Email ID, Mob. No., Nature of business activity)

- Proof of Additional Place of Business, if any, in JPEG format in maximum size of 100 KB (with address, Email ID, Mob. No., Nature of business activity)

- All Bank Account Details (With Opening page of Bank Passbook / Statement containing Bank Account Number of, Address of Branch, IFSC Code,Address of Account holder and few transaction details (PDF and JPEG format in maximum size of 1 MB)

- DSC Details, if available (with common name, Issuer name, Serial No., Expiry Date)

For Companies:

- Provisional ID received from State/Central Authorities

- Password received from the State/Central Authorities

- Valid Email Address

- Valid Mobile Number

- Bank Account Details

- Copy of Registration Certificate in any law (RC)

- Proof of Constitution of Business: Registration Certificate of the Business Entity (PDF and JPEG format in maximum size of 1 MB)

- Details of Promoters (With Name, DOB, Mobile No, Designation, PAN, Aadhaar No., Address Proof, Photograph of such person in JPEG format in maximum size of 100 KB)

- Proof of Appointment of Authorized Signatory such as copy of resolution passed by Board of Directors/Managing Committee in PDF or JPEG format in maximum size of 1 MB (With Name, DOB, Mobile No, Designation, PAN, Aadhaar No., Address Proof, Photograph of Authorized Signatory in JPEG format in maximum size of 100 KB)

- Proof of Principal Place of Business such as MOA and AOA or tax paid receipt or rent agreement or bank statement in JPEG format in maximum size of 100 KB (with address, Email ID, Mob. No., Nature of business activity)

- Proof of Additional Place of Business, if any, in JPEG format in maximum size of 100 KB (with address, Email ID, Mob. No., Nature of business activity)

- All Bank Account Details (With Opening page of Bank Passbook / Statement containing Bank Account Number of, Address of Branch, Address of Account holder and few transaction details (PDF and JPEG format in maximum size of 1 MB)

- DSC Details, if available (with common name, Issuer name, Serial No., Expiry Date)

Subscribe The Premium Service With Allindiaitr GST

-

Complete coverage over GST

With us, you will get assistance not only for the GST registration process but also for filing GST returns, validation process, and extended information on all GST laws.

-

Customized services

Our services are tailored with extreme customization to meet the specific needs of your business.

-

Smooth integrations

With us, you can integrate all industry standard tools into a customized platform to get a precise solution.

-

Integrated invoicing system

Use our bundled invoicing system instead of your own platform to work with simplicity.

-

Improved rating system

We offer improved tools to help determine supply chain actions along with applicable rates, according to the nature of goods and services.

-

Smarter Accounting system

Our smart accounting system matches invoices from vendors and buyers, helping you manage credit inputs.

-

Vendor management

We provide a fully integrated flow to help you control and manage vendor information.

-

Exclusive Offline feature

Our smart system allows offline access to various parts of our GST system.

-

Reporting system

We provide cashflow, credit, vendor, and statutory reports at multiple levels.