Calculate HRA Deduction

Use the HRA deduction calculator to find the portion of your income that is exempt from tax due to house rent payments.

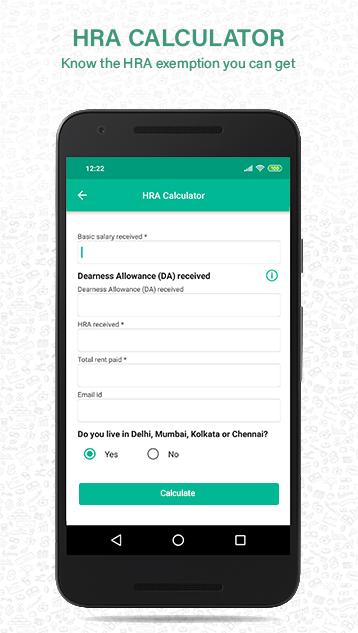

HRA Calculator

File your tax returns for AY 2025-2026 (FY 24-25)

31st July 2025 is the deadline to file your returns

- Your data is safe & secure

- All tax forms covered

- Upload form 16 and finish efiling

For any tax filing queries, write to us at support@allindiaitr.com.

Income Tax E-filing

Whether it's e-filing income tax returns, applying deductions, calculating tax liability, tracking refunds or responding to tax queries, AllIndiaITR is your one-stop destination for expert solutions.

Consult Tax Expert

Our in-house tax experts are ready to advise you on any tax-related queries.

An individual can claim House Rent Allowance (HRA) as an exemption from taxable income to cover rent related expenses. HRA deductions can be subtracted from income when calculating your tax liability. To avail this exemption, a salaried individual must provide the required documents, including rent receipts as proof of actual rent paid.

If a salaried individual resides in a rented apartment in a metro city, 50% of the basic salary is exempt; in a non-metro city, 40% is exempt. HRA received from the employer is generally exempt from taxes, subject to conditions.

As per section 10(13A) of the Income Tax Act 1961, an individual can calculate the HRA exemption by deducting 10% of the total salary from the actual rent paid. If no rent is paid, the HRA received becomes fully taxable.

How to use HRA Deduction Calculator

To maximize your deduction and calculate House Rent Allowance, follow these simple steps:

- Go to the HRA calculator page.

- Enter your basic salary.

- Input your Dearness Allowance.

- Provide the actual HRA received from your employer.

- Enter the actual rent paid.

- Select your city (metro or non-metro) accordingly.

- Enter your email address.

- Click on the Calculate button to view your HRA exemption details.

Frequently Asked Questions

Related Articles

House Rent Allowance...

House Rent Allowance is a component of salary that is partly exempted from tax...

Read More

Tips to Avoid Rejection...

HRA, a component of salary, can be subject to rejection if proper documentation is not provided...

Read More

Availing Exemptions on...

Tax exemption reduces the taxable income, thereby lowering your tax liability...

Read More