Income Tax Department Website – Login and Registration

Every Taxpayer who has tax liability must pay taxes and file income tax return for the same. In order to file tax return it is mandatory for the taxpayer to register on the Income Tax Department’s official e- filing portal.

Process to Register on the Income Tax Portal

With the steps mentioned-below, you can easily register yourself on the IT Department’s official portal: -

Step: 1 Visit the Income Tax Department’s official e-filing portal, on the homepage click on the option that says“Register Yourself”.

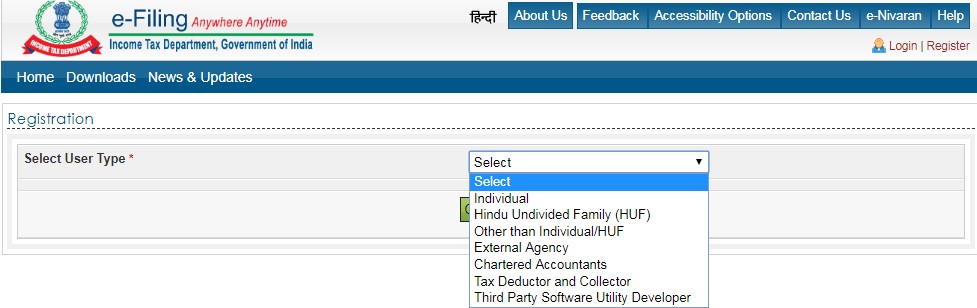

Step: 2 Select the User Type, once you click on the Register Yourself button, you will be redirected to a form that will ask you to select your use type.

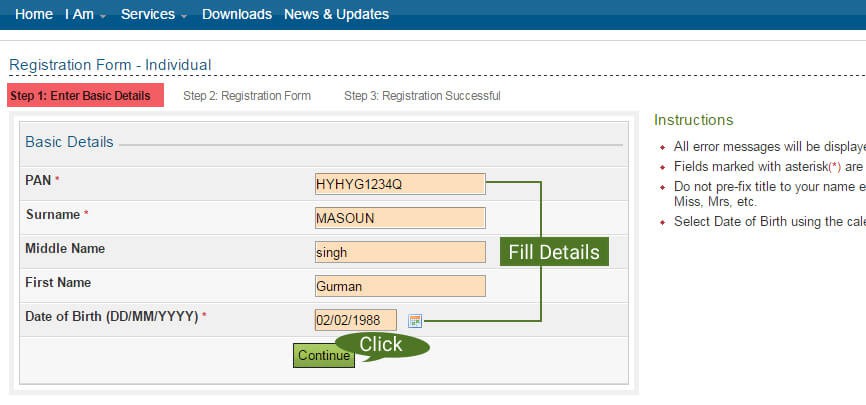

Step: 3 Enter your basic details

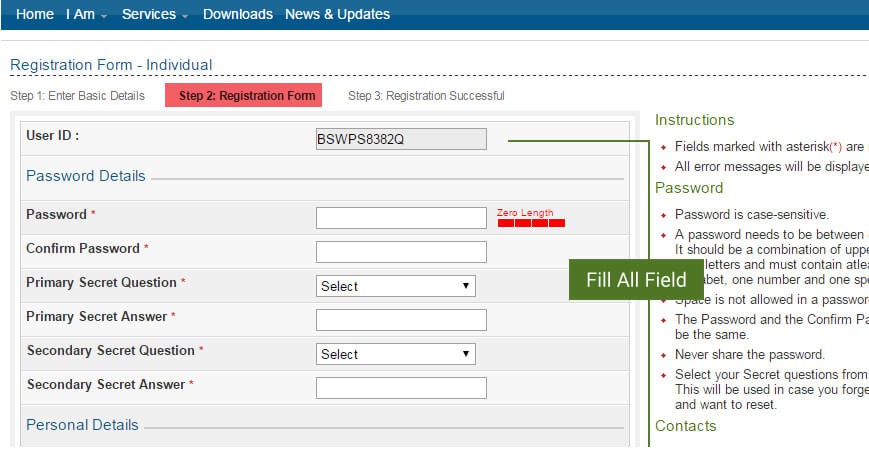

Step: 4

-

Fill the registration Form, following details are mandatory: -

- Password details

- Contact details

- Current address

- Secret Question

After correctly entering all the details, click on the submit button.

Step: 5 Verification: Once you submit the above-mentioned form, a 6-digit One Time Password (OTP) will be sent to your registered mobile number and the email ID. Enter this OTP correctly, in order to verify the details. If you are a non-resident the OTP will be sent to your registered email address.

The OTP will expire after 24 hours from the actual time of receipt. In case, one fails to complete the registration process within the given 24 hours, the entire registration must be initiated again.

How to login to the Income Tax Department’s official portal?

Step: 1 Visit the Income Tax Department’s e-filing portal, there you will find a button that says “Login Here”, all the registered users are supposed to click on this button to login.

Step: 2 Once you click on the “Login here” button, you will be redirected to the income tax filing login page, where you are supposed to enter your income tax login username and password.

NOTE: For Income Tax Return Filing, the User ID is your PAN Card Number.

You can file ITR without the hassle of registering with IT Department, just E-file ITR with All India ITR without any hassle.

Frequently Asked Questions

Income Tax Return can be filed in any of the following ways:

- By furnishing the returns in a hardcopy of the form.

- By furnishing the returns electronically, using a Digital Signature.

- By transferring the data electronically via an Electronic Verification Code.

- By filing for returns electronically and then submitting the verification of the return in Income Tax Returns Form ITR-V.

While filing for Income Tax Returns no other documents are required. But verification documents will be required during assessments and inquiry which is why it is advisable that a taxpayer must maintain these documents and be able to produce them when required.

If you have paid taxes on your own you may be asked to confirm this with the Challan Identification Number (CIN). This is the number you receive from a designated bank when you pay your taxes either offline or online at the tin nsdl portal.

Tax Guidelines

Tax Guidelines