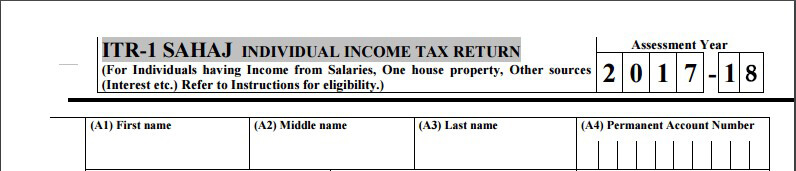

ITR-1 Sahaj Form - Eligibility, guideline and Form Structure

This page describes all the essentials you need to know about ITR-1 form including the details of eligibility, structure of the form, filing it and essential terms. It is the simplest form among all the income tax return forms. It applies to most of the salaried person except those who requires filing ITR-2 form.

Defining ITR-1 Form

ITR-1 form is also referred as “Sahaj” form, is designed for the salaried person to file income tax return with. Sahaj stands for “Easy” in Hindi and any salaried person including pensioners, family pension holder and person earn income by interest can use this form to file ITR. Usually, the deadline for filing income tax return with ITR-1 Form is 31st of July.

Eligibility to file income tax return with ITR-1 Form

For filing income tax return with ITR-1, taxpayers must have the followings included into their income:

- Earning from Salary or pension

- Earning from one House Property which must exclude the losses carry forwarded from last year.

- Income from Other Sources excluding the earnings generated from lottery and horse race.

If you are looking to club your spouse or minor child’s income into it than such can be done only if their income is also limited to the above specifications.

Ineligible to Use ITR-1 Form to File Income Tax Return

If any individual has income from any of the following sources, then they must not use the ITR-1 form to file income tax return:

- Income from business and profession

- Multiple house property income

- Taxable short term and long term capital gains

- Earnings from lottery, horserace or legal gambling etc.

- Agricultural income over INR 5000

-

A Resident Individual who has

- Assets including financial interest such as shares or bonds in any entity outside India.

- Signing authority for any account located in abroad.

- An individual who pays tax in the foreign country and claiming relief under DTAA under section 90 / 90A / 91.

The Sections of ITR-1 Form

ITR-1 or Sahaj Form has the following sections included into it:

- Part A: personal details such as name, PAN number and address

- Part B: Gross total income for the financial year

- Part C: Details of all deductions and total taxable income

- Part D: Details of tax calculation and tax status

- Schedule IT: Details of advance tax and self-assessment tax payments

- Schedule TDS1: Details of TDS deducted from salary as mentioned in Form 16 issued by your employer

- Schedule TDS2: Details of TDS deducted from income from other sources as mentioned in Form 16A issued by the deductor.

- Supplementary schedules of TDS1, TDS2 and IT.

Filling the ITR-1 Form

Before start filling out the ITR-1 form, you must keep this documents ready in your hand:

- PAN card details

- Bank account details including interest earned, passbook and FD certificates

- Form 16 issued by the employer and in case of multiple employers, you need all of them

- Form 26AS and make sure that TDS mentioned in Form 16 matches with the TDS mentioned in Part A of Form 26AS

- Also, keep the receipts of deductions you have submitted to your employer and want to claim deductions against them.

Essential Terms used in ITR-1 Form

Advance Tax:TDS is advance tax paid by the salaried individual. But if you have earnings generated from FDs, savings accounts, rental income, bonds and capital gains and if your total tax payable amount exceeds INR 10,000 per year then you need to file advance tax in instalments. The instalments need to be filed in September, December and March.

Notice Number:If you have received any notice from Income Tax Department and filling ITR in response of that, then this section should be filled by you.

Self-Assessment Tax Payments:This refers to the difference between tax payable and tax paid which you need to pay before you file your return. While filing ITR, first fill out the details of advance tax paid by you and calculate your income. Once you calculated it, you will find the amount of tax you need to pay and fill in that details in this section.

Revised Return:If you have discovered any fault in your last filed income tax return form, then you can re-file a revised ITR

Annexure-less Return:It means you do not have to attach any documents with ITR-1 Form.

How do I file my ITR-1 Form?

ITR-1 Form can be filed through online and offline mode depending on your choice. However, any taxpayer with income over INR 5 lakhs must file their income tax returns electronically.

Online / Electronic Mode:

- By filing income tax return electronically under digital signature

- The data will be transmitted electronically and a verification will be generated in the form of Form ITR-V upon submitting.

Offline:

- By filling ITR in a physical paper form

- By filling ITR a bar-coded return

The IT Department will issue ITR-V which is an acknowledgement of submission of the physical paper return.

For e-filing under digital signature, the acknowledgement form will be sent to the registered email ID. You can download it manually from the website, then sign it and send it to the CPC office located in Bangalore within 120 days from the date of e-filing ITR.

Sending ITR-V to the CPC Office?

Refer our guide to “How to send ITR-V to CPC Bangalore” to understand the process correctly.

Frequently Asked Questions

Yes, in that case, you need to file ITR with the ITR-2 form. The exemptions can be claimed under such condition are:

- HRA

- LTA

- Transport Allowance

Types of ITR Forms

Types of ITR Forms