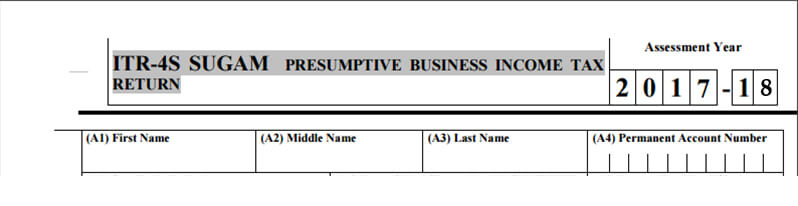

ITR-4 Sugam Form - Form Sections and Eligibility

This page describes all the essential parts and filling information about the ITR-4 Sugam form. This income tax form is designed for the businesses which file income tax returns for the presumptive incomes as mentioned under section 44AD.

Defining ITR-4 Sugam Form

This form is designed for the business who choose to pay income tax for a presumptive income. This scheme is designed for section 44AD and section 44AE. However, this scheme is valid only for the businesses that have income below INR 1 Cr per FY. For the businesses with income exceeding INR 1 Cr need to use ITR-4 to file income tax return.

Section 44AD: Presumptive Income & Its Taxation

Small businesses usually do not maintain an account book to keep a track on their income flow. To help such businesses with paying income tax, IT department has provisioned this special income tax form called ITR-4 Sugam Form. This provision allows such small businesses to file ITR for a presumptive income on estimation base.

This scheme offers:

- Total income must be estimated at a rate of 8% of the gross receipts of the business.

- No account book maintenance is required.

- Advance tax payment is not required.

- No business expense deduction is allowed against income under this scheme.

In case of declaring an lower incoem than 8%, an account book is needed to be produced. In the case of multiple businesses of such type, you have to choose the method separately for each business. Only one method will be considered under this scheme, and for others, you have to show audit report and account book. The advance tax payment exemption will be also valid for this business only which is opted under this scheme covered under section 44AD. Any taxpayer claiming deduction under section 10 / 10A / 10B / 10BA / 80HH / 80RRB can not adopt this scheme.

Eligibility to file income tax return with ITR-4 Sugam Form

Scheme Eligibility:

- Gross income should be under INR 1 Cr PA

- Only applicable to Indian Resident

- Only applicable to the individual, HUFs, Partnership firms

- Not applicable to Companies

Businesses that are not eligible:

- Commission or brokerage income based business

- Agency business

- Plying, hiring or good renting businesses

- Any legal / engineering / medical / architectural / accountancy / technical consultancy / interior decoration / film artist, company secretary, and IT personnel

Eligible Deductions:

- No expense based deductions are allowed

- No depreciation based deductions is also allowed

- Separate deductions are allowed for partnership businesses against remuneration and interest paid to partners

Section 44AE: Presumptive Income For Plying, Rental Or Trucks Hiring Businesses

This scheme offers:

- Net income assumed to be INR 7,500 pm for heavy goods vehicle

- No account book maintenance is required

- Advance tax payment is also not required

- No business expense deduction is allowed

Scheme eligibility:

- Plying, Rental Or Trucks Hiring Businesses only

- Not more 10 goods carriages owning is allowed

- Only applicable to the individual, HUFs, Partnership firms

Eligible Deductions:

- No expense & depreciation based deductions are allowed

- Separate deductions are allowed for partnership businesses against remuneration and interest paid to partners

The Sections of ITR-4 Sugam Form

- Part A: general information regarding taxpayer and business

- Part B: Gross total income from the five heads of income

- Part C: Deduction applicable and total tax liable income

- Part D: Tax calculation and status

- Verification & signatures on the return

- Schedule IT: particulars of advance-tax payment and tax on self-assessment

- Supplementary schedule IT

- Schedule TDS1: details of applicable TDS on salary

- Supplementary schedule TDS1

- Schedule TDS2: details of applicable TCS on income except for salary

- Supplementary schedule TDS2

- Schedule-TCS: details of TCS.

- Supplementary schedule TCS

-

Schedule BP - Details of business income including the following:

- Calculation of presumptive income under 44ad

- Calculation of presumptive income under 44ae

- Financial details of the business

Filling the ITR-4 Sugam Form

ITR-4 Sugam form can be filed through online and offline mode. Yet, following category of taxpayers need to file this income tax form online:

- With an annual income is over INR 5 lakhs

- Owns foreign assets

- Claims relief under section 90 / 90A / 91 in Schedule FSI and Schedule TR

Online / Electronically:

- By filing online return using digital signature

- By electronically transmitting the data

- Sending the Form ITR-V to CPC Bangalore

Offline:

- File income tax return with a physical paper form

- File a bar-coded income tax return

- A physical ITR-V will be provided at the time of submission

Types of ITR Forms

Types of ITR Forms