| Nature of Income | Section | Rate of Tax | Section Code |

|---|---|---|---|

| Tax on accumulated balance of recognized PF | 111 | To be calculated according to the rule 9(1) of Part A of the fourth Schedule | 1 |

| Short Term Capital Gains | 111A | 15 | 1A |

| Long term capital gains including indexing | 112 | 20 | 21 |

| Long term capital gains excluding indexing | 112 | 10 | 22 |

| Income dividends and interest from units purchase in foreign currency | 115A (1)(a) | 20 | 5A1a |

| Income from technical services or royalty, where agreement entered between 31.3.1961 to 31.3.1976 in case of royalty and between 29.2.1964 and 31.3.1976, and agreement is approved by the Central Govgernment. | Paragraph EII of Part I of first schedule of the Finance Act | 50 | FA |

| Income from technical services or royalty | 115A (1)(b) if agreement is entered on or before 31.5.1997 | 20 | 5A1b1 |

| Income from technical services or royalty | 115A (1)(b) if agreement is entered on or after 31.5.1997 but before 1.6.2005 | 20 | 5A1b2 |

| Income from technical services or royalty | 115A (1)(b)if agreement is on or after 1.6.2005 | 10 | 5A1b3 |

| Income received in respect of units brought in foreign currency by a off-shore fund | 115AB (1)(a) | 10 | 5AB1a |

| Earnings by way of long-term capital gains arising from the transfer of units purchase in foreign currency by a off-shore fund | 115AB (1)(b) | 10 | 5AB1b |

| Earnings from bonds or GDR purchases in foreign currency or capital gains arising from their transfer in case of a non-resident | 115AC (1) | 10 | 5AC |

| Earnings from GDR purchased in foreign currency or capital gains arising from their transfer in case of a resident | 115ACA (1) | 10 | 5ACA |

| Profits and gains from life insurance business | 115B | 12.5 | 5B |

| Winnings from lotteries races including horse races crosswords puzzles card games and gamblings or betting of any form or nature | 115BB | 30 | 5BB |

| Tax levied on non-residents sports associations or sportsmen | 115BBA | 10 | 5BBA |

| Tax levied on income from units of an open – ended equity oriented fund of the Unit Trust of India or of Mutual Funds | 115BBB | 10 | 5BBB |

| Unspecified donations | 115BBC | 30 | 5BBC |

| Income from long-term capital gains | 115E (a) | 20 | 5Ea |

| Income from investment | 115E (b) | 10 | 5Eb |

| Double Taxation Agreement | DTAA |

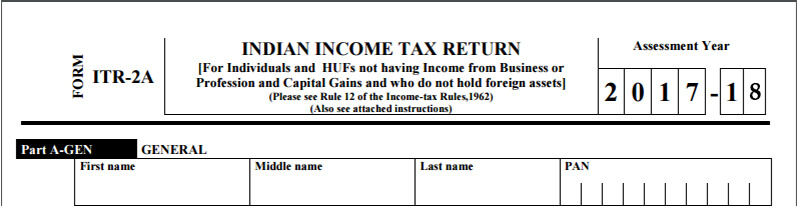

ITR-2 Form - Eligibility, guideline and Form Structure

This page is about ITR-2 Form and it’s essential know-about which a taxpayer need to know if they fall under the prescribed form category. This page includes descriptions for eligibility, form structure, filing instructions and essential terms and conditions.

Defining ITR-2 Form

Any individual or HUFs who do not generate any income from business or profession need to use ITR-2 form to file annual income tax returns. Taxpayers using ITR-2 need to furnish their income tax return by 31st July of every year.

Eligibility to file income tax return with ITR-2 Form

This for, is specific to the taxpayers including individuals and HUFs, who earn income from the following sources:

- Salary / Pension

- House Property

- Short term and long term capital gains

- Other Sources including Lottery, Race Horses and legal gambling

- Foreign Assets

Ineligible to Use ITR-2 Form to File Income Tax Return

- Any taxpayers including individuals and HUFs earn from Business or Profession

- Individuals who file ITR with the ITR-1 Form

- Individuals or HUFs who are partners in a Partnership Firm

The Sections of ITR-2 Form

ITR-2 is divided into multiple parts and schedules which require you to fill in the related information regarding your tax information.

The Parts in ITR-2 form:

- Part A: general required information

- Part B-TI: calculation of total income

- Part B-TTI: calculation of tax liability imposed on total income

- Details to be filled if the return has been prepared by a Tax Return prepared

The schedules are:

- Schedule S: salary income details

- Schedule HP: house property income details

- Schedule CG: calculation capital gains income

- Schedule OS: calculation of income from other sources.

- Schedule CYLA: details of income after settling off current year's losses

- Schedule BFLA: details of income after settling off the unabsorbed loss brought forwarded from the earlier years.

- Schedule CFL: details of losses need to carry forward to coming years.

- Schedule VIA: details of deductions from total taxable income under Chapter VIA.

- Schedule 80G: details of donations eligible for deduction under section 80G.

- Schedule SPI: details of income earned by spouse / minor child / son's wife or any other family member which will be included in the taxpayer’s total income in Schedules-HP, CG, and OS.

- Schedule SI: details of income liable to taxed at special rates

- Schedule EI: details of exempted Income

- Schedule IT: details of advance tax and tax on self-assessment payments.

- Schedule TDS1: Details of TDS deducted on salary.

- Schedule TDS2: details of tax deducted at source on income other than salary.

- Schedule FSI: details of income earned from abroad

- Schedule TR: details of taxes paid in abroad

- Schedule FA: details of Foreign Assets.

- Schedule 5A: details of apportionment of income between spouses governed by Portuguese Civil Code.

Codes that prescribe special rates of tax that need to be filled in Schedule SI

Filling the ITR-2 Form

Filling instructions for ITR-2

While filling ITR-2 form, must keep these points in mind:

- Strike out or write "---NA---" across the schedule not applicable to you.

- Write "NA" against for the item not applicable to you.

- For nil figures, write in "Nil".

- For negative figures, put a "-" sign before it.

- All figures must be rounded off to the nearest one rupee except for the total income/loss and tax payable figures as these need to be rounded off to the nearest multiple of ten.

- The individual taxpayers must tick on Government if they are Central / State Government employee under the Employer Category. For the employees of public sector company of the Central / State Government, they must tick on PSU.

- Those who claim double taxation relief under Section 90/90A/91, must not use this form.

Filling Sequence for parts and schedules

The best sequence to follow while filing ITR-2 is:

- Part A

- All the schedules

- Part B-TI

- Part B-TTI

- Verification

ITR-2 Form can be submitted online or offline.

Offline:

- By furnishing income tax return in a physical paper form

- By furnishing a bar-coded income tax return

An acknowledgment will be issued at the time of submission of your physical paper return by The Income Tax Department.

Online / Electronically:

- By filing the return electronically under digital signature

- By transmitting the data electronically

- Submitting the verification in Return Form ITR-V

It is compulsory to E-file income tax returns electronically for the following categories:

- Those who earn more than Rs. 5 lakhs per year

- Those having foreign assets or signing authority in any account in abroad

- Those claiming DTAA relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applies

The acknowledgment will be sent to your registered email id in the case of e-filing ITR using the ITR-2 Form under digital signature. Also, one can download it manually from the official income tax website and then you are required to sign it and send it to the CPC office in Bangalore within 120 days from the day of e-filing.

No annexures required

No attachments or documents need to be attached while sending ITR-2.

Frequently Asked Questions

Certain incomes is exempted from tax liability under section 10 of the Income Tax Act. They include:

- HRA

- LTA

- Transport allowance

- Gratuity

- Leave encashment

- Pension

Types of ITR Forms

Types of ITR Forms