File Your ITR Smartly in 2025 – Fast, Secure, Hassle-Free

Finish your Income Tax Return in just 2 minutes with expert guidance, tailored for all taxpayers—salaried professionals, crypto traders, business owners, freelancers, and beyond.

Take control of your taxes – file your ITR yourself using Form 16 or other documents in just a few clicks.

Perfect for salaried individuals or those with simple income sources looking for a quick, cost-effective solution.

Let our expert Chartered Accountants handle your taxes, including complex income like crypto, stocks, and foreign earnings.

Simplify tax planning and filing with our suite of free, user-friendly tools.

From calculating taxes to generating documents, our tools save you time and effort – no hidden costs!

Watch How We Make

Taxes Easy

From starting a new venture to managing compliances, our business services empower entrepreneurs at every step.

Business Formation

Compliances

Company Updates

GST Solutions

Business Services

Whether you’re registering a company, filing GST returns, or updating business details, our expert team ensures a seamless experience with affordable pricing and timely support.

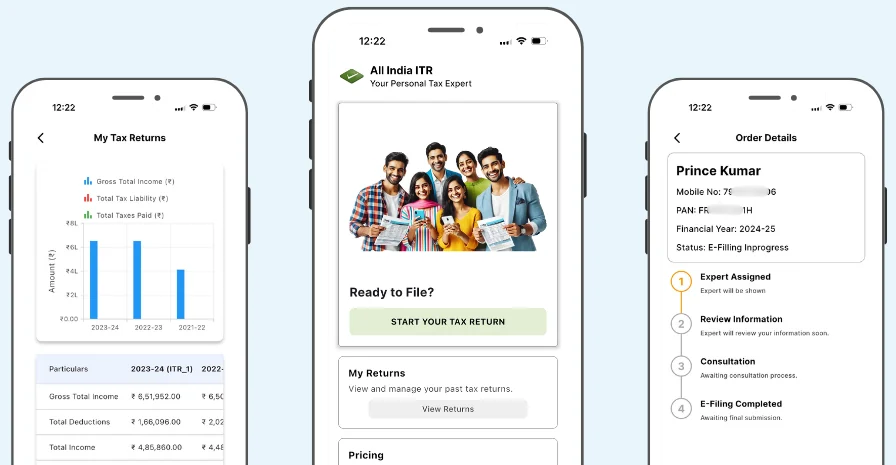

Take charge of your taxes on the go – file ITRs, track refunds, calculate taxes,

and access expert advice with our top-rated mobile app.

4.8/5 rating from over 10,000 reviews – join the millions who trust us for seamless tax management!

Google Play

App Store

We’re more than just a tax filing platform – we’re your partner in financial success, delivering unmatched value and expertise.

Your sensitive data is safeguarded with 128-bit encryption and advanced security protocols. Join over 1.5 million users who trust us to keep their information secure.

Our team of seasoned Chartered Accountants and tax experts is available round-the-clock to make filing and compliance a breeze, no matter your income type.

Enjoy premium tax services at prices that fit every budget, starting at just ₹599. We’re committed to affordability without compromising quality.

Maximize your savings with these expert-backed strategies tailored for the latest tax regime.

Save up to ₹1.5 lakh under Section 80C by investing in Equity-Linked Savings Schemes, offering tax benefits and market-linked returns.

Reduce your taxable income with House Rent Allowance if you’re a salaried individual living in rented accommodation – use our HRA Calculator!

Offset gains from stocks or property with crypto trading losses under the new tax rules for FY 2025-26.

Got questions about ITR filing, crypto taxes, or business compliance? Find quick, reliable answers below!

All India ITR is India’s leading online tax filing platform, offering Expert Assisted ITR filing, business services, and free tax tools for individuals and businesses.

Sign up, choose a plan (Expert Assisted), upload your documents (like Form 16), and either file yourself in 2 minutes or let our experts handle it.

You’ll need Form 16, bank statements, investment proofs (e.g., 80C), and income details like crypto or stock gains, depending on your income sources.

filing is free with our tools, while Expert Assisted plans start at ₹599 for salary + interest income, up to ₹5999 for businesses.

For AY 2025-26, the deadline is typically July 31, 2025, unless extended by the Income Tax Department.

Yes, we support belated filing for up to two previous years (e.g., AY 2023-24, 2024-25) with expert assistance.

Use our Expert Assisted crypto plan (₹2999) tools to report gains/losses under the 30% tax and 1% TDS rules.

Crypto gains are taxed at 30%, with a 1% TDS on transactions above ₹10,000, as per current laws.

Short-term gains (STCG) are taxed at 15%, long-term (LTCG) at 10% above ₹1 lakh – our CA plan (₹2499) simplifies this.

Form 16 is a certificate issued by your employer detailing salary and TDS, essential for ITR filing.

Yes, our NRI + Foreign Income plan (₹2799) caters to non-residents with expert support.

The new regime offers lower tax rates but fewer deductions – check our blog for the latest slabs.

You can opt for the old or new regime each year during ITR filing – our experts can guide you.

Section 80C allows deductions up to ₹1.5 lakh for investments like ELSS, PPF, or insurance.

Submit rent receipts and use our HRA Calculator to claim exemptions if you live in rented housing.

It’s a simplified scheme for small businesses/professionals with turnover below ₹2 crore, taxed at a fixed rate.

Yes, use salary slips, bank statements, or Form 26AS to file without Form 16.

Use our free Refund Status Checker with your PAN and assessment year details.

We use 128-bit encryption and comply with GDPR standards to protect your data.

A Chartered Accountant files your ITR, ensuring accuracy and compliance for complex incomes.

Typically 1-2 days after document submission, depending on complexity.

Yes, file a revised return by December 31, 2025, for AY 2025-26 with our help.

It’s your tax credit statement showing TDS, advance tax, and other payments.

Use Aadhaar OTP, net banking, or send ITR-V to CPC Bangalore – see our guide.

ITR-1 is for individuals with income up to ₹50 lakh from salary, one house, or interest.

Individuals or HUFs with business/professional income or capital gains use ITR-3.

It’s mandatory for businesses with turnover above ₹20 lakh (₹40 lakh for goods) to collect GST.

Use our Business Formation service – we handle DIN, DSC, and MCA filing for you.

Tax Deducted at Source is tax withheld by payers (e.g., employers) before paying you.

Our experts analyze your notice and draft a response starting at ₹999 – see our service.

Refer friends and earn ₹150 cashback each when they file their ITR with us.

Yes, legal heirs can file with proper documentation – contact our experts.

It’s tax paid quarterly if your liability exceeds ₹10,000, avoiding penalties.

Use our free tool or CA service to compute gains from stocks, property, or crypto.

A mandatory audit for businesses with turnover above ₹1 crore or professionals above ₹50 lakh.

No, the new regime offers lower rates but no deductions like 80C or HRA.

Use our Salary + Property plan (₹699) to report rental income accurately.

It’s the acknowledgment form you receive after filing ITR, needing e-verification or mailing.

Check it on our portal or the Income Tax e-filing site with your PAN and acknowledgment number.

It’s your unique tax ID required for ITR filing, financial transactions, and tax payments.

Yes, report losses (e.g., crypto, stocks) to carry forward and offset future gains.

No minimum, but it’s mandatory if income exceeds ₹2.5 lakh (old regime) or ₹3 lakh (new regime).

Use our Business/Professionals plan (₹5999) for partnership ITR-5 filing.

A DSC is an electronic signature for secure online filing, often required for businesses.

Use our Company Updates service to change name, address, or directors hassle-free.

Penalties range from ₹10,000 to ₹1 lakh – ensure compliance with our TDS service.

Yes, our app lets you file, track, and manage taxes anytime, anywhere.

Call us toll-free at 1800-419-9661 or chat live 24/7 on our website/app.

We offer the lowest prices, expert support, modern tools (e.g., crypto tax), and a 98% satisfaction rate.